Reading time:

Tuesday, January 27, 2026

Kestrl, a UK ethical FinTech, today announced a landmark strategic partnership with Maybank Islamic Berhad, the Islamic banking arm of Malaysia’s largest bank, Maybank Group, to launch a first-of-its-kind, "Values-as-a-Service" solution for UK users.

The partnership bridges the gap between London’s world-class FinTech innovation and Malaysia’s global leadership in Islamic finance — a system that prohibits the charging or payment of interest and other activities deemed to be unethical, such as gambling, tobacco, or high-leverage debt.

Starting today, the solution will offer users a comprehensive digital experience that aligns financial growth with personal faith-led values and ethical principles.

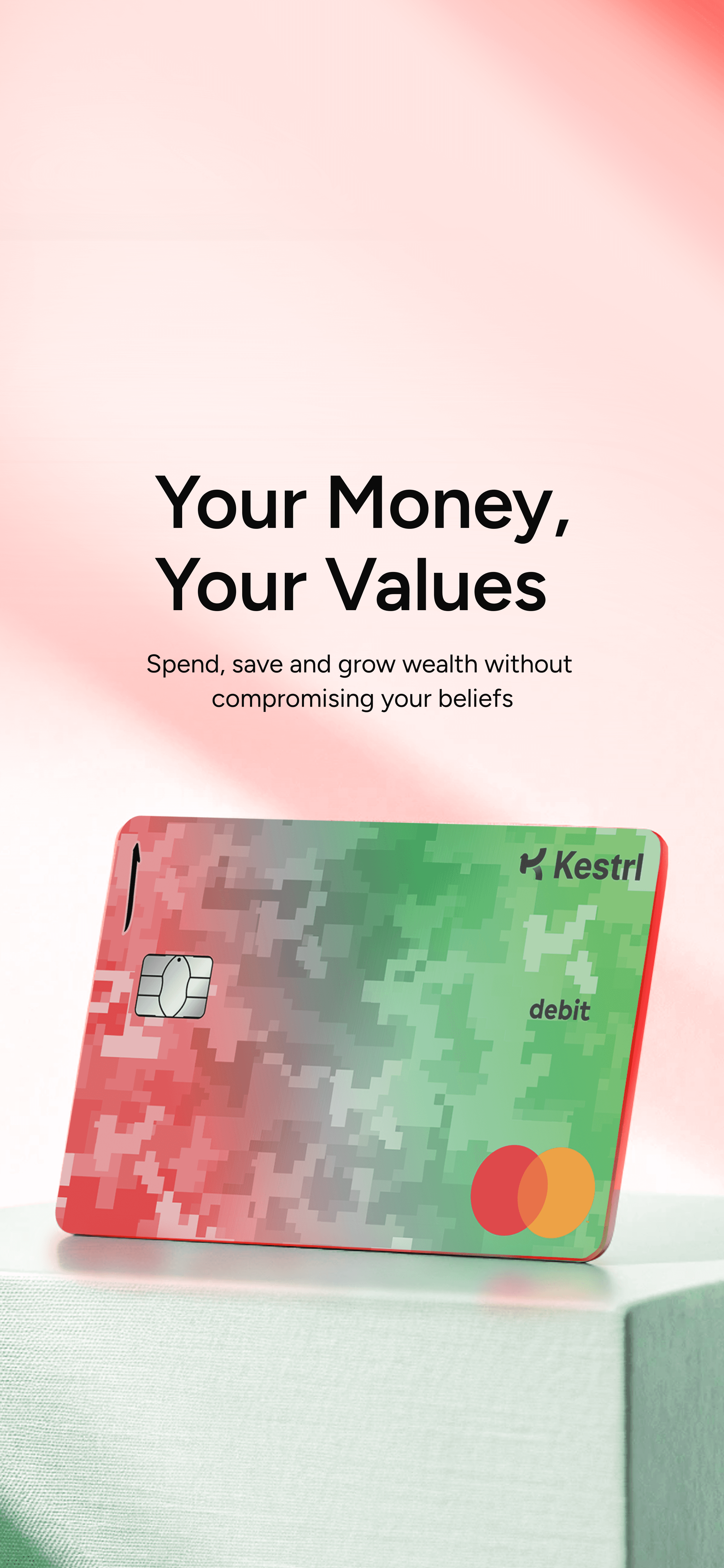

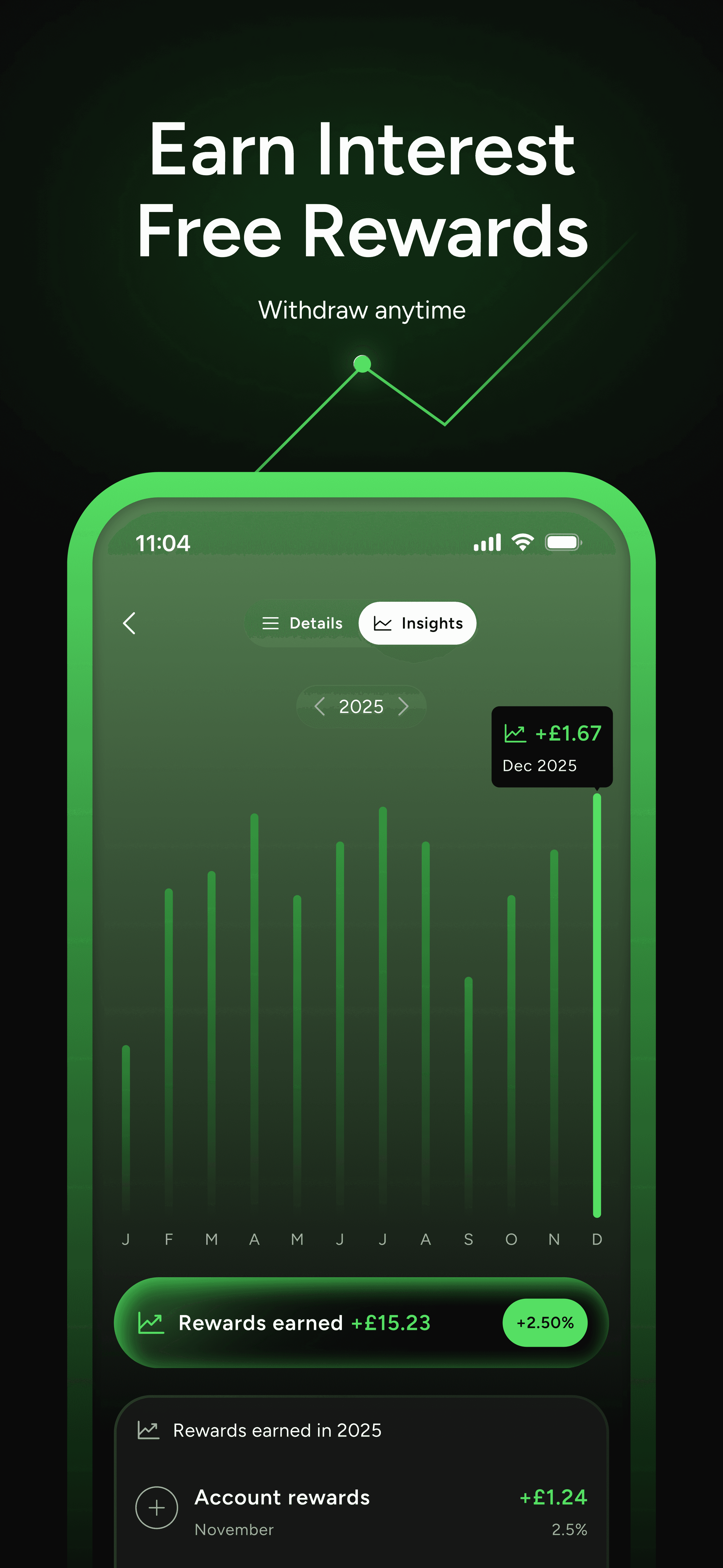

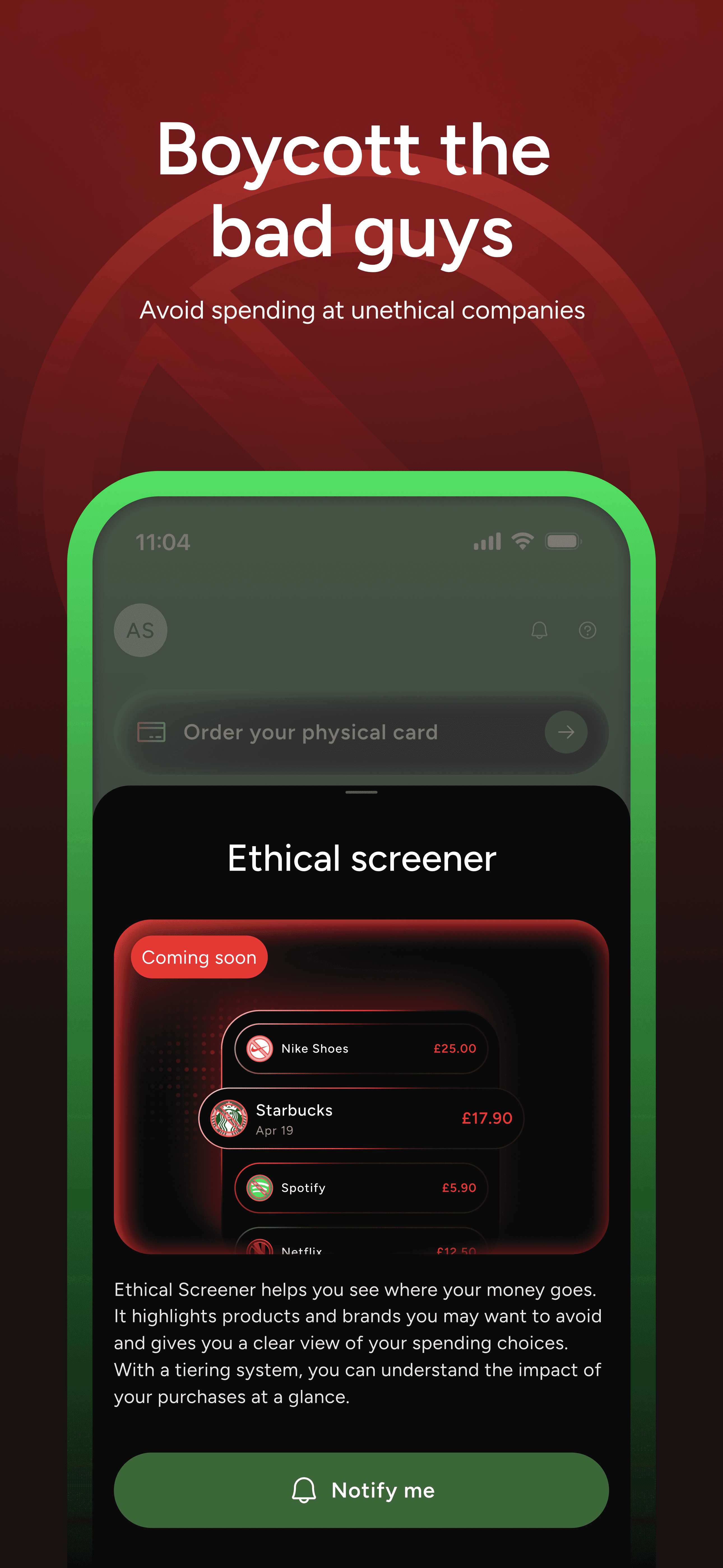

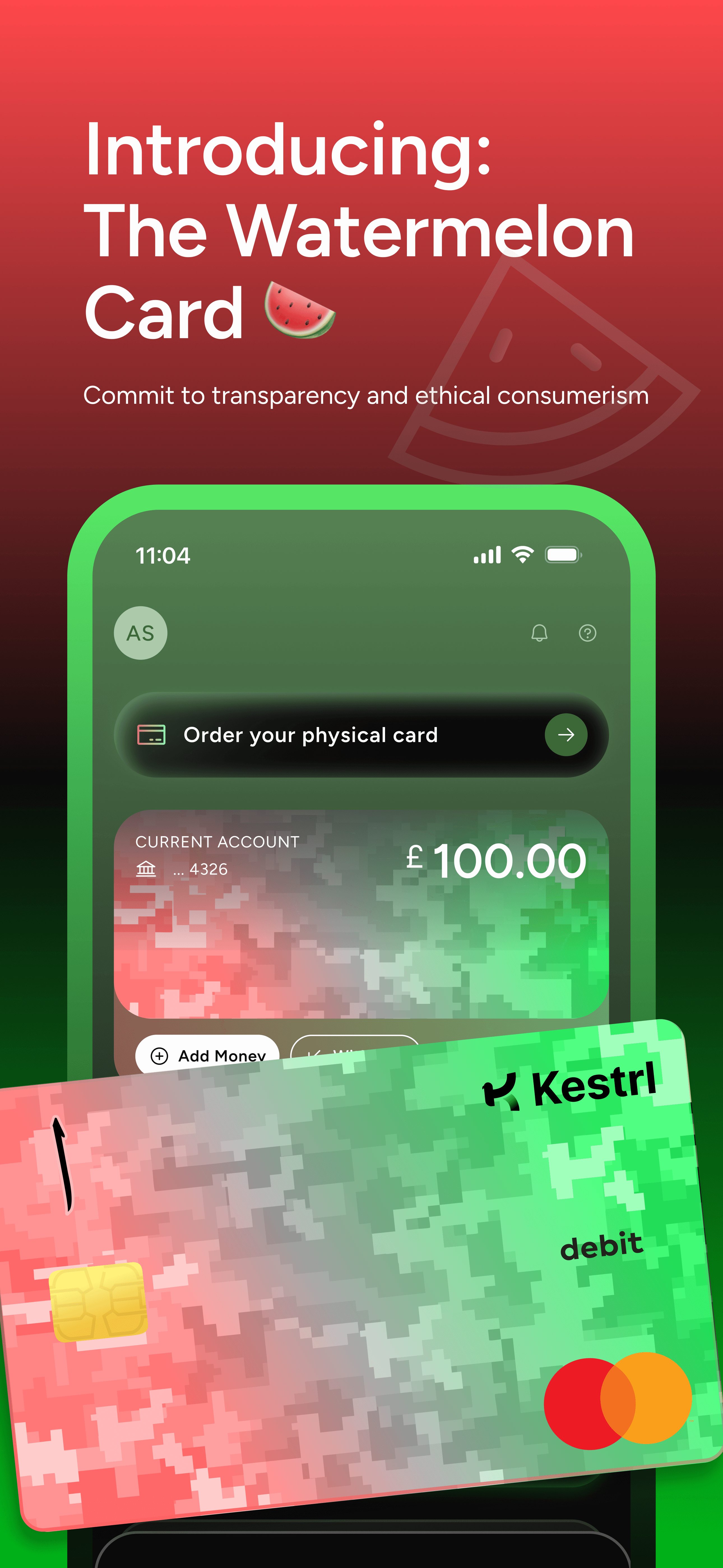

The Kestrl proposition features a dedicated spending account and debit card integrated with a proprietary real-time ethical screening tool, designed to align consumer habits with personal and religious values. Central to the offering is Maybank’s role as the custodial provider, ensuring that money is stored in a religiously compliant manner through its UK entity, Maybank London — a significant breakthrough for the UK's 4 million Muslims and the broader ethically-driven community.

The collaboration comes at a time when the global Islamic finance market is projected to exceed $6 trillion. By providing a seamless digital interface for complex faith-based products, Kestrl and Maybank are positioning themselves at the forefront of the "Values-as-a-Service" movement.

Areeb Siddiqui, CEO of Kestrl, commented:

"Our collaboration with Maybank represents a watershed moment for UK FinTech and for Islamic Finance in general. For too long, Muslim customers have had to choose between solutions that align with their beliefs and those that offer an amazing user experience. By combining Kestrl's digital innovation with the institutional strength of Maybank, we are finally delivering a solution that allows consumers to grow their wealth and manage their daily spend without having to compromise on their values. We hope that this solution can help redefine the blueprint for ethical finance on a global scale.”

Mohamad Yasin Abdullah, CEO of Maybank Islamic, added:

“This partnership marks an important step in extending Malaysia’s global leadership in Islamic finance into the UK’s dynamic FinTech ecosystem. By combining Maybank Islamic’s balance sheet strength, governance, and Shariah expertise with Kestrl’s digital innovation, we are enabling a new model of banking — one that is values-led, fully digital, and accessible to a broader generation of customers. This collaboration demonstrates how Islamic finance can be scaled globally through technology without compromising its principles.”

Hamdi Abdullah, General Manager of Maybank London, stated:

“Maybank Group is committed to driving the expansion of Islamic finance globally. Our collaboration with Kestrl allows us to bring our Tier-1 banking experiences and ethical solutions to a new generation of digitally native users in the UK. By embedding our Shariah-compliant custodial capabilities into a modern FinTech platform, we are unlocking new possibilities for ethical finance — not just for Muslims, but for anyone seeking a more responsible way to manage their money.”

The solution is expected to onboard customers through the first half of 2026, with plans to expand the offering to include financing solutions and advanced wealth management tools later this year.

About Kestrl - Kestrl is a UK-based, values-driven FinTech dedicated to helping Muslims and ethical consumers manage their money in accordance with their beliefs. Through its innovative app and "screening" technology, Kestrl empowers users to spend, store, and grow without compromise. For more information, visit kestrl.io.

About Maybank Islamic - Maybank Islamic is the Islamic banking arm of Maybank Group, the largest financial services group in Malaysia and one of the leading banking powerhouses in Southeast Asia. A global leader in Islamic finance, Maybank Islamic is ranked No. 1 in the Asia Pacific region and fourth worldwide by asset size, and offers a comprehensive range of Shariah-compliant financial solutions.

The Kestrl Mastercard is issued by AF Payments Limited pursuant to a licence by Mastercard International. AF Payments Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900440) for the issuing of electronic money and payment instruments. Mastercard and the Mastercard brand mark are registered trademarks of Mastercard International.

As a registered EMI, AF Payments holds your funds in a safeguarding account which offers protection if AF Payments goes out of business. It is important to know that as a non-bank payment provider, your money is not protected by the Financial Services Compensation Scheme (FSCS)

Media Contact: Aziah Ahmed Comms Lead, Kestrl Email: aziah@kestrl.io